Fix City Finances 4: How Cities Get More Revenue … and More Revenue Powers

A bigger slice of the pie. And new pies!

This is the fourth in a series of common sense solutions for fixing municipal finances.

The structural imbalance in Canadian public finance

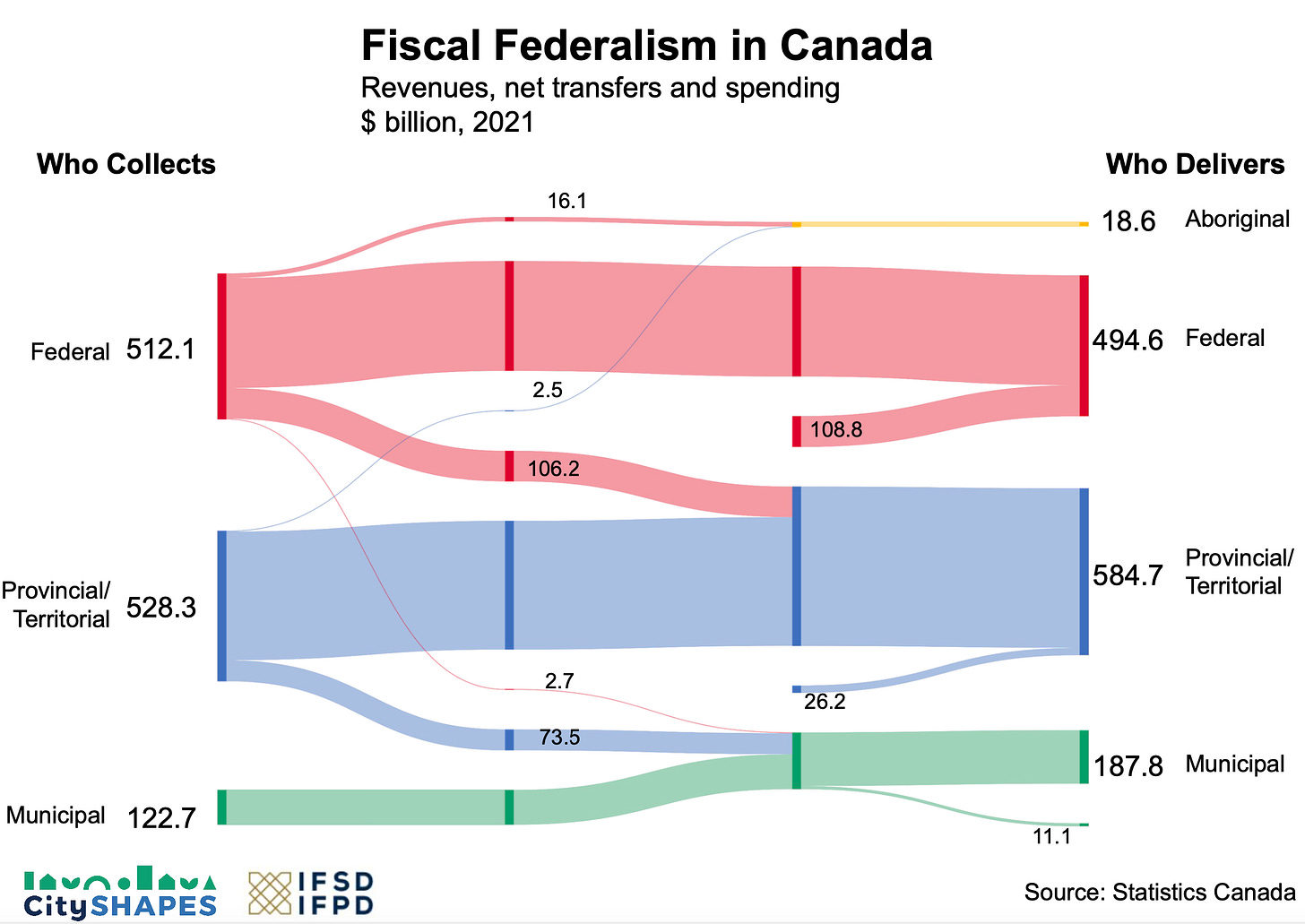

Some of you will remember seeing a version of this chart before. It showed the percentage share between the feds, provinces and cities of who collects taxes and who delivers programs.

We are reproducing that graphic with the dollar amounts. There is one line in particular we want to bring to your attention.

That tiny red line is set to grow …

What’s most interesting in this chart is the transfers from higher to lower levels of government. That speaks to the imbalance between who collects money and who delivers services to Canadians.

In 2021, the feds transferred $106 billion to provinces and territories. P/Ts transferred $74 billion to cities.

There is another very interesting transfer; the tiny $2.7 billion red line from the feds to cities.

This includes about $2 billion in what we used to call the gas tax. It also includes COVID transfers.

That tiny red line will grow. We’ve seen an uptick in federal government decisions over the past few years to send money straight to municipalities, such as:

$4 billion for a Housing Accelerator Fund

$3 billion annually for a Permanent Transit Fund, starting in 2026

$400 million for an Active Transportation Fund.

… but how fast it grows is up to cities

Fed-to-city transfers is an emerging trend. Whether it would continue under a new government of different political stripes is anyone’s guess.

It’s up to cities to advocate for themselves to make that fed-to-cities transfer grow faster.

Individual mayors can lobby the federal government for more money on specific issues. But that’s relatively easy for the feds to deflect, or treat as a one-off.

For long-term structural increases in this transfer, cities need to work together. They need a simple and consistent message.

Simply complaining that cities are cash-starved is not going to achieve a lot.

The Federation of Canadian Municipalities has created a Big Cities Mayors’ Caucus. That caucus can lead the push, and be responsible for getting everyone singing from the same hymn book. But they need a compelling reason for this transfer that everyone can relate to.

We think housing is that compelling reason.

A new $6 billion Canada Housing Transfer

We’ve previously proposed a Canada Housing Transfer to cities, to go alongside the Canada Health and Social Transfers to provinces and territories.

The Canada Housing Transfer would provide municipalities with an unconditional transfer for each home they built, with more cash for the types of housing we want to prioritize.

A $6 billion annual transfer would aim to see about 600,000 new homes built in Canada every year – the amount CMHC says we need to restore affordability within a decade. (Currently, we are completing about 160,000 homes a year across the country).

$6 billion sounds like a lot of money. But it is also the amount the government is freeing up for reallocation to higher priorities, through its latest spending review exercise.

This means the government could earmark that $6 billion in future annual savings to whatever priority it chose at no incremental cost to taxpayers.

For Canadians, is there a higher priority right now than housing affordability?

New revenue powers

In addition to getting their fair share of the tax dollar pie, cities will need to come up with additional revenue sources. That $6 billion transfer is only the start of what’s required.

Right now, most municipalities have control over one source of revenue: property taxes. But property taxes have their own challenges, and are politically difficult to raise in many jurisdictions.

Cities are actively considering new options for raising revenues. At this point, all options should be on the table.

Some of the more widely discussed options include:

Municipal income taxes

Municipal sales taxes

Vacant home taxes

Land transfer taxes on high-value property sales

Foreign buyer land transfer taxes

Commercial parking levies

Traffic congestion charges

Motor vehicle registration fees

Surcharges on lift-sharing services

At this point, we’re not advocating for any specific option. Every city is different and needs to make its own choices, based on what it considers feasible.

Furthermore, higher levels of government have control over whether cities can put many of these new tools into practice. New York City is on the cusp on implementing a traffic congestion charge, using that money to fund public transportation. That congestion charge has taken 16 years to work its way through higher-up approvals.

More revenue, more revenue tools

Cities are cash-strapped. Many have large future liabilities, for which they have no revenue source.

Canadian cities need to work together to solve their shared financial predicament.

This means more resources transferred from higher levels of government. Cities will also need those same higher levels to provide the authority to test out new revenue tools.

Cities are the economic juggernauts of this country. If they work together, they can be a powerful force. It’s overdue for cities to engage the federal government as a block, united behind a simple message. We suggest “cash to cities to build housing”.

It does not matter how much of the financial pie you get. As a Gold Rush driven GDP means your cost well out strip your ablity to pay and only a privileged few well walk away a financial winner and the community well be left with the problems . $$ on its own cannot fix. As we broke economic and business 101 sustainablity principles of sustainablity and fixing tgat we’ll require something we are not very go at. Accepting change in not what humans do but how we do it. Causing controlled deflation. the experts say cannot be done. Actually we had the ability for over a decade, but it require collaboration and that something we seem to have to lose a lot more. Before they realize. Either change or be left behind in a Global community structure . Based on Star Trek global federation . That remove $ from the head of the table to being at the table to address unsustainable problems tgat have no borders. Just on going cost. To our sustainablity.

One thing you learn from being part of actual change starting in college. You cannot fix a 2 decade old Gold Rush driven GDP with a 20th century horse& buggy silo driven tools. But you can with the 21st century sustainability investment system & tools already proven that once you remove $$ from the head of the table to being at the table. Attached to sustainablity. Comes down to simply applying economic and business 101 sustainability principles.but the first words you well hear. I understand we need change. Just has long has what you change has no impact on what I do or how I do it and the benefits to me and my support system. Change is a bitch. Getting in trouble is easy, the longer it’s around the less positive impact $$ has until at sometime. Either restructure to address it or become part of economic history where a privileged few win & the community are force to collaborate and apply innovation to do what $$$ screwed up but no longer can address on its own. Everything’s there. COVID showed us what is possible through collaboration, Mother Nature showing us why we need to change. Then we have those that think like Trump or Putin. Pissing off the educated young. Who actual is no value in $$ nor power already creating a Global federation to wonder the stars based on Star Trek(1968) version structure, 80% already in place. Going to be an interest decade. As we mature as a Global community.