Fix City Finances 3: Cities Need to Work Together to Get Their Fair Share of Funding

It's time for a new fiscal federalism, and cities need to join forces to make it happen.

This is the third of six common sense solutions for fixing municipal finances.

Cities Are Getting the Short End of the Stick

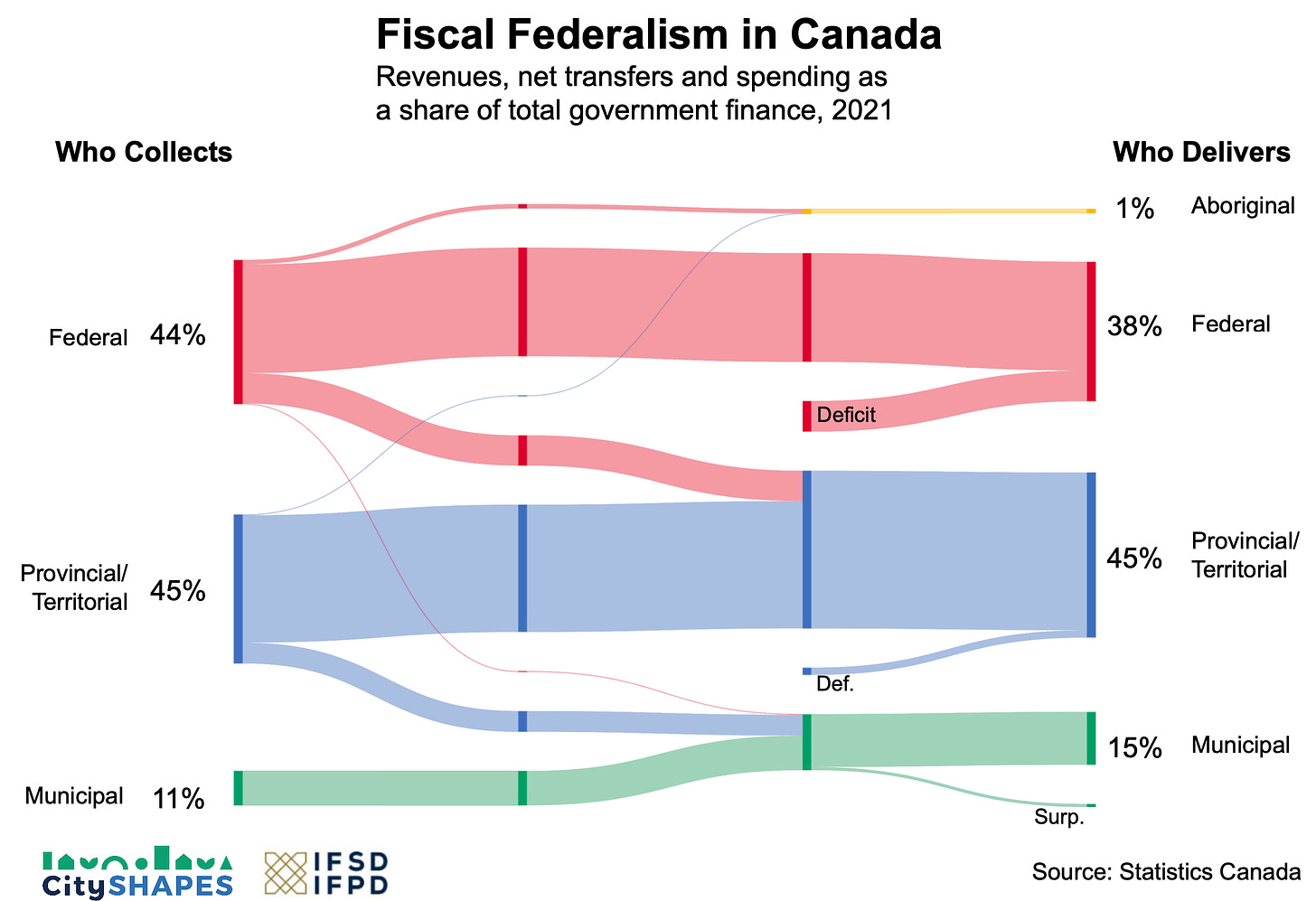

For every dollar in taxes you pay in Canada, 11¢ is collected by cities. The feds take in 44¢ and provinces get 45¢. (See graphic above, which we pulled together with the Institute of Fiscal Studies and Democracy.)

But cities are being asked to deliver a lot more than 11% of all public services in Canada.

Think of the front line services that city governments provide. Roads, sewers, fire, police, ambulances, water, garbage, recycling, libraries, parks, swimming pools, community centres, affordable housing, emergency shelters, snow removal … and so much more.

For some of these services, higher levels of government help out. Municipalities across Canada spent $65 billion more than they collected in taxes (out of a total of approximately $200 billion in combined municipal budgets) – and this additional spending comes from federal and provincial transfers, since cities, by law, cannot run operating deficits. But higher levels of government are unpredictable in providing this funding.

While municipalities collect 11% of all tax revenue, they deliver 15% of all government services. And if we look at homeless shelters and other city services that are bursting at the seams, municipalities are really being asked to deliver a lot more than the 15% they can afford to pay for.

Time for a New Fiscal Federalism

City finances are simply not sustainable. Cities are key to solving housing, climate and many other of the key challenges facing Canadians, but they don’t have the budgetary resources to succeed.

In short, cities need a new fiscal arrangement with higher levels of government.

Cities get a modest amount of gas tax revenue from both the feds and provinces. But this is peanuts compared to the transfers that provinces and territories have negotiated with the federal government, for health, social programs and equalization payments.

The federal government has been creating ad hoc funding for municipal capital investments, but these funds have little stability into the future, and furthermore, do not support ongoing operating expenses. Sooner or later, the federal government will have to find a way to directly or indirectly support some level of municipal operating expenses.

Cities Need to Speak with One Voice

It’s no surprise that the federal or provincial governments are not volunteering up a greater share of tax revenue to cities.

But that is what is needed. Municipalities probably need closer to 20% of all tax revenues to meet the demands placed on cities.

Cities are only going to get their fair share of tax revenues if they sing from the same hymnbook and demand a seat at the table. In fact, cities will have to insist that a new table be established – a table to discuss a fair allocation of tax resources between federal, provincial/territorial and municipal governments.

The Federation of Canadian Municipalities has established a Big City Mayors Caucus. That’s a great start.

We just need cities to now understand how powerful they can be working together, and how they can most effectively start throwing their collective weight around.

Wow, what a fantastic graphic, thank you for sharing that! Putting this in a global context (or at least comparing to the top 30+ OECD countries), Canadian provinces and municipalities are delivering more services than any other sub-national government source:https://imgur.com/a/jTeXRRs