Fix City Finances 7: How to Get a New Deal for Cities

Cities are still being asked to do too much with too little of the tax dollar. Cities need to push back together and demand more.

This is the seventh in a series of common sense solutions for fixing municipal finances.

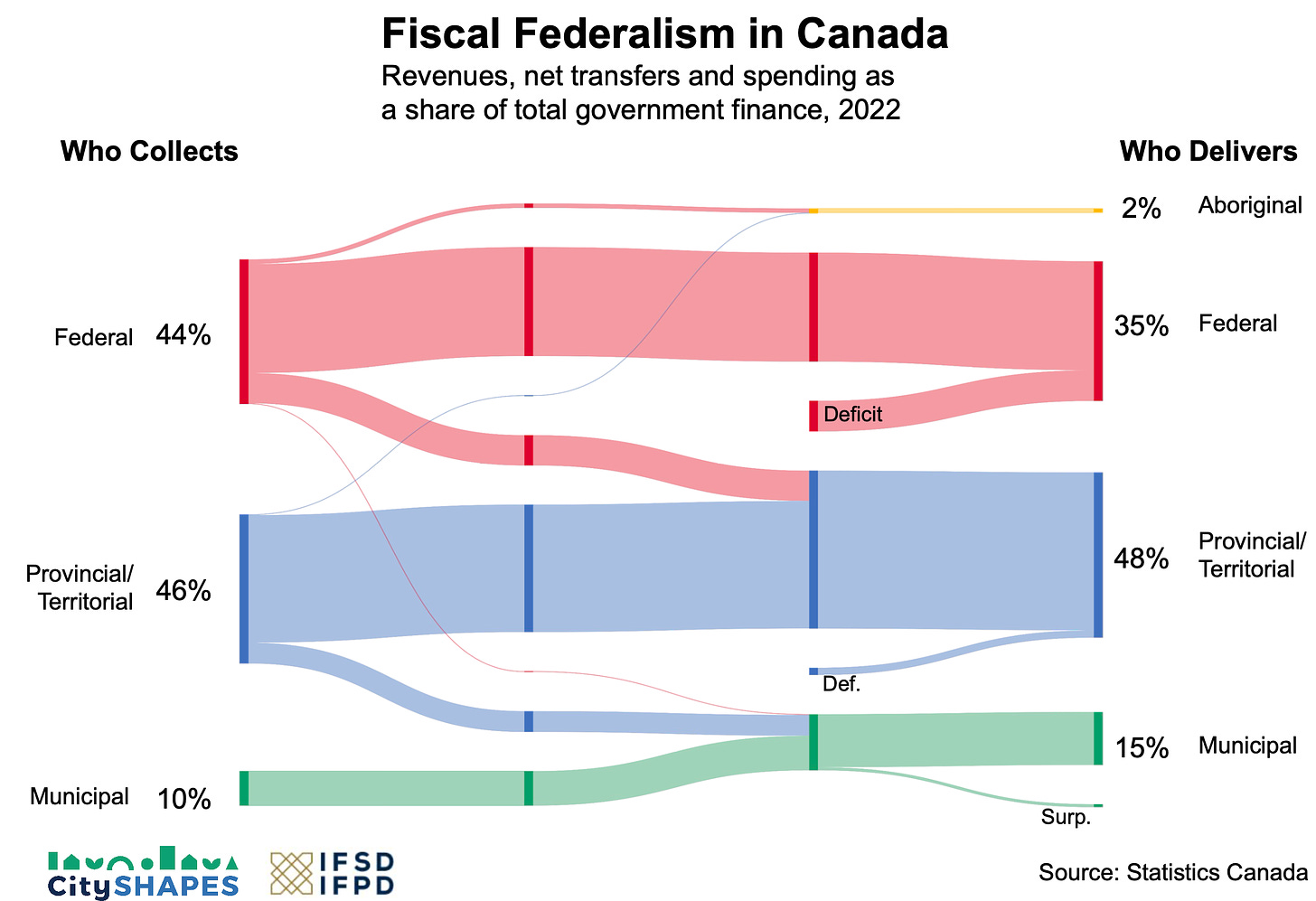

Keen readers will remember seeing this graphic in our newsletter last year. We’ve updated it with 2022 data.

A structural imbalance

Despite new data, the story remains the same.

There is a structural imbalance in Canada between which level of government collects money and which level delivers services.

The federal government collects 44% of all tax revenues but only delivers 35% of government services. In contrast, municipalities collect 10% of revenues but deliver 15% of all government services.

The difference is made up through transfers, mostly from the federal to provincial governments, and from provincial to city governments.

For cities, those transfers are not always reliable. And they are often insufficient to provide the service required.

For example, across much of the country, cities are on the front lines dealing with a homelessness crisis, but without sufficient funding. A report for the Region of Waterloo found city taxpayers covering 47% of homelessness and supportive housing costs. The province pays only 42%, while federal contributions cover 11%.

A new fiscal federalism

Cities are being asked to do too with too few resources. City finances are at a breaking point.

It’s time for a more equitable share of the tax dollar for cities. Not surprisingly, neither the federal nor provincial governments are offering that up.

Cities need to work together and proactively to demand a new fiscal federalism. Cities should be insisting on a seat at the table where the federal and provincial governments negotiate how the tax dollar is divided up.

Toronto shows the way forward

Toronto Mayor Olivia Chow scored a recent victory, securing $143m for refugee settlement costs. That came as part of a $362m top-up to the federal Interim Housing Assistance Program, following pressure from Toronto, other cities and the Quebec government.

Chow successfully used the threat of elevated municipal tax increases to leverage federal funding.

Now imagine if municipalities across the country worked together to demand a fair share of the tax pie. Cities could have significantly more influence with the federal government if they worked together in presenting a consistent picture of the funding shortfalls for the key front line municipal services that people rely on day-in day-out.

The Big City Mayors’ Caucus of the Federation of Canadian Municipalities is a good place to start this coordinated effort. But that work needs to be more assertive, more strategic and more sustained.

Flip the Housing Accelerator Fund into a Canada Housing Transfer

Cities should focus their lobbying efforts around a top issue of the day and for which cities have primary responsibility. Housing, of course, is the obvious issue where municipalities have an outsized role.

The federal Housing Accelerator Fund is working well to incentivize municipalities to build homes. Cities could demand that this model be turned around on its head.

Specifically, cities should jointly demand a Canada Housing Transfer from the federal government, as an incentive to build. That transfer could go directly to cities, in the same way that the roughly $100 billion annual Canada Health and Social Transfers go to provinces and territories.

We have previously proposed a $6 billion annual Canada Housing Transfer, in which cities would be paid $5,000 to $18,000 per home built in the previous year. This would be like the Housing Accelerator Fund on steroids, and could help to restore housing affordability within a decade.

A Canada Housing Transfer is an idea whose time has come. But it is only going to become a reality if cities demand it.

Stronger together

Toronto can flex. But most other Canadian cities have limited influence with higher levels of government when working alone.

Together, cities can be seen as a powerful force.

Cities control many of the key government services that Canadians rely on. But the level of service they can provide depends on whether federal and provincial governments give cities a fair share of the tax dollar.

Working together, Canadian municipalities can demand a new deal for cities.

The housing crisis just might be what brings such a new deal to life.